Pull data from HMRC

Accountants, clients and individual taxpayers can use APARI to pull data from HMRC and populate the Self Assessment tax return. It’s a powerful feature that means you don’t need to search for the documents yourself.

We can retrieve information from your employer(s) and pension provider(s), as well as some state benefits.

The data usually becomes complete in the September after the tax year has ended*, for example in September 2024 for the 2023-24 tax return.

*We’d love to get it sooner but this is a limitation from HMRC. When MTD (eventually) comes around, this feature will get even more powerful as we retrieve data in real-time and cover more information, such as CIS Deductions.

connecting to HMRC

To access this feature, you first need to set up a connection to HMRC.

Accountants: from your Accountant Dashboard, go to Profile & Settings and select HMRC Connection.

Taxpayers: from your Dashboard, got to Profile & Settings and select Data Connections. In the 3rd Party Accounts tab, select Connect new account.

The software will guide you through the steps to make the connection.

You’ll need your Government Gateway ID and password. HMRC will ask you to authorise APARI to access this information and may run some additional identity checks.

Pro tip for accountants: use the Government Gateway ID which holds the authorisations for Self Assessment clients (64-8).

Once connected

You will now be able to retrieve information from HMRC. Accountants access the feature from the client dashboard.

First, make sure you’ve entered the Unique Taxpayer Reference (UTR) correctly in Profile & Settings > Personal Data.

Then, go to Profile & Settings > Data Connections > 3rd Party Accounts.

On the HMRC Connection box, expand the section labelled Account.

Select Pull Data from HMRC.

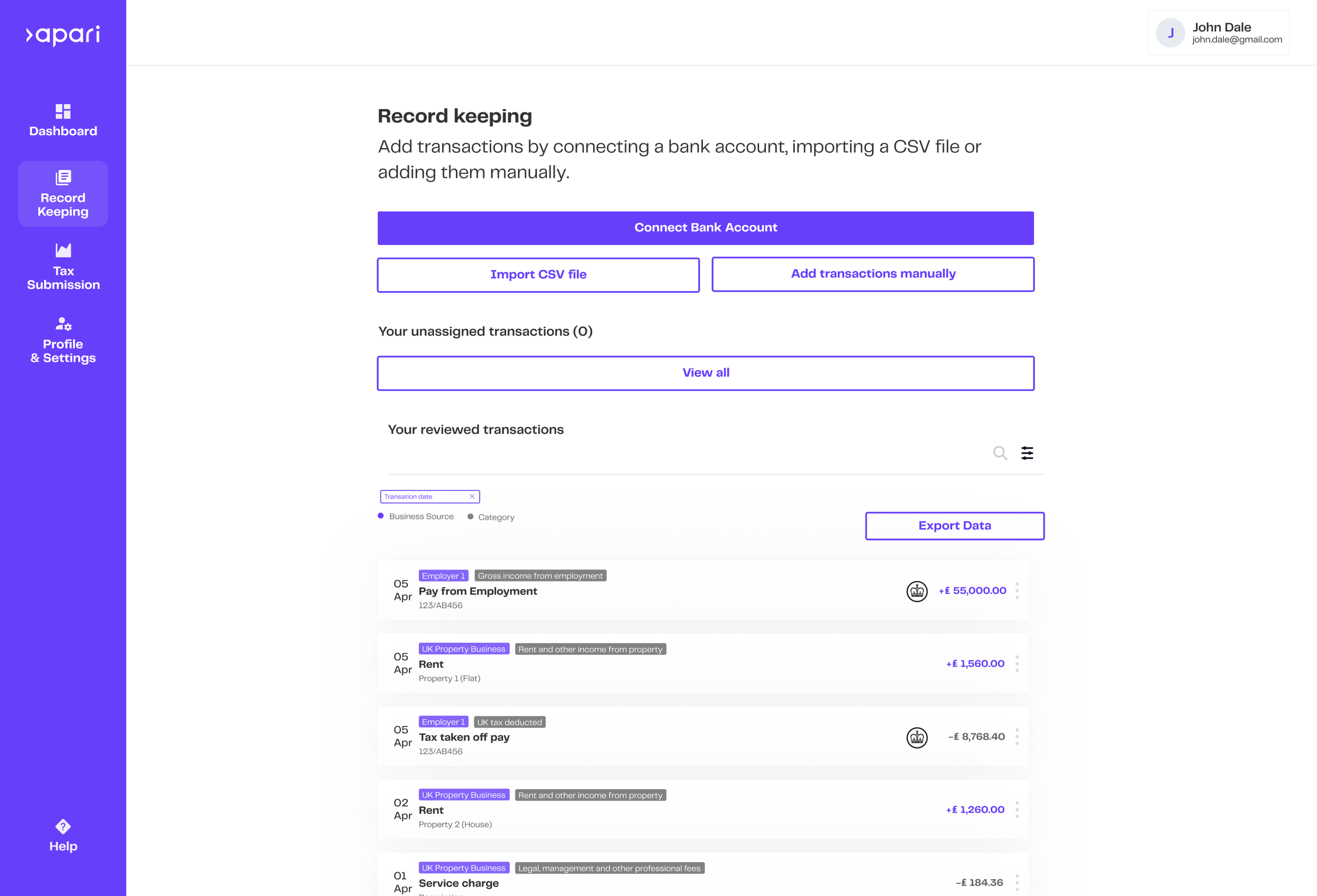

Once the retrieval completes successfully, we will automatically update the list of employers in APARI, add the data to the record keeping area and populate the tax return. In the record keeping area, data retrieved from HMRC is marked with an icon.

Troubleshooting

Occasionally HMRC’s data isn’t correct and complete!

They may not return any information. We don’t get a specific explanation for this. If you’re ready to do your tax return, our recommendation is not to wait. Instead, enter your employment and pension information manually.

They may return incorrect information. In this case, you can edit your tax return manually or delete all of the information retrieved from HMRC in one click.